AI Startup Valuation What Makes Some Companies Worth Billions

Discover what drives AI startup valuations to billions. Learn key valuation factors, metrics, and strategies for 2025 success in artificial intelligence

The AI startup valuation landscape has undergone a dramatic transformation, with 498 AI unicorns worth a combined $2.7 trillion as of 2025. Understanding what drives these astronomical valuations has become crucial for entrepreneurs, investors, and industry observers alike. The artificial intelligence sector has created unprecedented wealth, generating at least 15 billionaires from just four major private AI companies, including OpenAI, Anthropic, and others.

The valuation of AI startups differs significantly from traditional tech company assessments. While conventional startups rely heavily on user acquisition and revenue multiples, AI companies command premium valuations based on proprietary algorithms, data assets, and technical breakthroughs. The median AI pre-money valuations range from $3.6M for pre-seed to $795.2 for Series C rounds, with top-tier companies achieving multiples that defy traditional metrics.

The current artificial intelligence valuation environment reflects both immense opportunity and substantial risk. LLM vendors command average revenue multiples of 44.1x, far exceeding typical SaaS benchmarks. However, these valuations require careful analysis beyond surface-level revenue figures. Factors such as computational capital intensity, technical sustainability, and path to profitability have become the new determinants of long-term value.

Investors are increasingly sophisticated in their AI company valuation approaches, moving beyond speculative hype toward financial sustainability and commercialization strategies. The market has witnessed record-breaking funding rounds, with OpenAI raising $40 billion at a $300 billion valuation leading 2025’s largest AI funding rounds. This evolution represents a maturation of the AI investment landscape, where proven business models and defensible competitive advantages drive the highest valuations.

AI Startup Valuation Fundamentals

What Makes AI Startups Different

AI startup valuation requires a fundamentally different approach compared to traditional technology companies. Unlike conventional startups that build value through customer acquisition funnels and network effects, AI companies derive their worth from proprietary algorithms, curated datasets, and computational capabilities. The core differentiator lies in their ability to create artificial intelligence solutions that solve complex problems at scale.

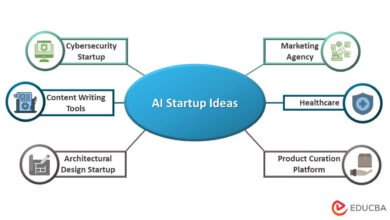

The artificial intelligence valuation methodology centers on three critical pillars: technical innovation, data quality, and market application. Technical innovation encompasses the sophistication of machine learning models, algorithmic efficiency, and breakthrough capabilities that competitors cannot easily replicate. Data quality refers to the volume, accuracy, and uniqueness of training datasets that fuel AI model performance. Market application involves the practical implementation of AI solutions in real-world scenarios that generate measurable business value.

AI company valuation also considers the talent density and research capabilities of the founding team. Given the specialized nature of artificial intelligence development, companies with renowned AI researchers, published academic papers, and proven technical track records command significant valuation premiums. The scarcity of top-tier AI talent creates a competitive advantage that directly translates to higher investor confidence and market valuations.

Key Valuation Metrics for AI Companies

Modern AI startup valuation relies on metrics that extend beyond traditional financial indicators. Revenue growth consistency and market penetration potential serve as clear indicators, but AI-specific metrics provide deeper insights into long-term viability. These include model accuracy improvements, inference speed optimizations, and computational cost reductions over time.

Machine learning valuation methodologies incorporate technical performance benchmarks such as F1 scores, AUC-ROC curves, and model interpretability measures. These metrics directly correlate with commercial viability and competitive positioning. Companies demonstrating consistent improvements in these technical metrics while reducing computational overhead typically receive higher valuations from sophisticated investors.

Median revenue multiples for AI companies sit around 25-30x EV/Revenue, with top deals achieving far higher multiples. However, these multiples require contextualization within the broader AI ecosystem. Companies with proven unit economics, clear paths to profitability, and scalable business models justify premium multiples, while early-stage ventures rely more heavily on technical potential and market opportunity assessments.

The Billion-Dollar Valuation Framework

Revenue Multiples and Financial Metrics

Startup valuation methods for billion-dollar AI companies transcend simple revenue multipliers. Revenue multiples fail catastrophically for AI companies because they ignore capital intensity, technical sustainability, and the path to profitability. Successful AI valuations require a comprehensive analysis of unit economics, including computational costs per customer served, model training expenses, and infrastructure scalability requirements.

AI company valuation at the billion-dollar level involves sophisticated financial modeling that accounts for the unique cost structure of artificial intelligence businesses. Unlike traditional software companies with near-zero marginal costs, AI companies face ongoing computational expenses, data acquisition costs, and model retraining investments that directly impact profitability projections.

The most successful AI startup valuation frameworks incorporate scenario-based modeling that accounts for technological advancement curves, competitive landscape evolution, and regulatory compliance costs. Billion-dollar valuations typically require demonstrated ability to achieve positive unit economics at scale, with clear visibility into gross margin expansion as the business matures.

Technical Moats and Competitive Advantages

Artificial intelligence valuation premiums stem from defensible competitive moats that prevent easy replication by competitors. Technical moats include proprietary algorithms, exclusive datasets, specialized hardware optimizations, and unique model architectures that deliver superior performance. Companies with proprietary AI models or processes that provide a competitive edge command higher valuations.

The strength of technical moats directly influences AI startup valuation sustainability over time. Companies with patent portfolios covering core innovations, exclusive partnerships with data providers, and custom silicon implementations create barriers to entry that justify premium valuations. These technical advantages become increasingly valuable as the AI market matures and competition intensifies.

Machine learning valuation experts evaluate moat strength through competitive benchmarking, intellectual property analysis, and technical due diligence processes. The most valuable AI companies demonstrate clear technical superiority that translates into measurable business advantages, such as higher accuracy, faster processing speeds, or lower operational costs compared to alternatives.

Market Size and Growth Potential

A billion-dollar AI company valuation requires massive addressable markets with significant growth trajectories. Total Addressable Market (TAM) size and growth velocity serve as fundamental valuation drivers. AI companies targeting healthcare, autonomous vehicles, enterprise automation, and financial services benefit from multi-trillion-dollar market opportunities that support astronomical valuations.

AI startup valuation models incorporate market penetration scenarios that account for technology adoption curves, regulatory approval timelines, and competitive dynamics. Companies demonstrating early traction in large, fast-growing markets receive valuation premiums based on potential market capture rather than current revenue generation alone.

The most successful artificial intelligence valuation stories involve companies that create entirely new market categories or fundamentally transform existing industries through AI innovation. These market-creating opportunities justify valuations that appear disconnected from current financial metrics but reflect the transformative potential of artificial intelligence technology.

Factors That Drive Sky-High Valuations

Proprietary Technology and IP Portfolio

AI startup valuation reaches extraordinary levels when companies possess truly proprietary technology that cannot be easily replicated. Algorithmic superiority serves as a direct indicator of competitive edge, particularly when protected by comprehensive intellectual property portfolios. Patents covering novel neural network architectures, training methodologies, and optimization techniques create sustainable competitive advantages.

The artificial intelligence valuation premium for proprietary technology reflects the time and resources required for competitors to develop similar capabilities. Companies with breakthrough innovations in areas such as transformer architectures, reinforcement learning algorithms, or computer vision processing command valuations that recognize the years of research and development investment required to achieve similar performance levels.

AI company valuation experts assess technology differentiation through technical benchmarking, peer review analysis, and independent verification of claimed performance improvements. Companies demonstrating measurable advantages in accuracy, speed, or efficiency compared to open-source alternatives justify premium valuations based on their technological moats.

Data Assets and Network Effects

Machine learning valuation increasingly recognizes data assets as primary value drivers. Companies with exclusive access to high-quality, labeled datasets benefit from compound advantages as their models improve through increased usage. Data monetization potential plays a pivotal role in shaping a startup’s perceived value. Network effects emerge when additional users generate more data, improving model performance and creating barriers to competitive entry.

AI startup valuation models must account for data acquisition costs, data quality metrics, and the sustainability of data advantages over time. Companies with proprietary data collection mechanisms, exclusive partnerships with data providers, or unique data generation processes maintain competitive advantages that justify premium valuations.

The most valuable artificial intelligence valuation scenarios involve companies where data assets become self-reinforcing. Each additional customer or transaction generates more training data, improving model performance and attracting more customers in a virtuous cycle that creates increasingly defensible market positions.

Team Quality and Execution Track Record

AI company valuation heavily weighs the quality and experience of the founding and technical teams. Team strength represents a critical valuation factor, particularly in AI, where specialized expertise remains scarce. Companies led by renowned AI researchers, former executives from successful tech companies, or teams with proven track records in bringing AI products to market command significant valuation premiums.

Startup valuation methods for AI companies include a comprehensive team assessment focusing on technical credentials, research publications, industry recognition, and previous startup experience. The ability to attract and retain top-tier AI talent becomes a competitive advantage that directly translates to higher investor confidence and market valuations.

AI startup valuation models recognize that execution capability often determines success more than initial technical innovation. Teams with demonstrated ability to scale AI products, navigate regulatory challenges, and build sustainable business models receive higher valuations based on their proven execution track record rather than theoretical potential alone.

Industry Benchmarks and Case Studies

Unicorn Success Stories

AI startup valuation success stories provide valuable benchmarks for understanding what drives billion-dollar outcomes. AI coding startup Replit achieved a $3 billion valuation with $250 million in new funding, demonstrating how AI-powered developer tools can achieve massive valuations through clear market need and scalable solutions.

OpenAI represents the pinnacle of artificial intelligence valuation, with a $300 billion valuation following a $40 billion funding round. This valuation reflects the company’s breakthrough achievements in large language models, widespread product adoption, and potential to transform multiple industries through artificial intelligence capabilities.

Scale AI and other billion-dollar funding recipients demonstrate that AI company valuation success requires combining technical excellence with clear business model execution. These companies achieve unicorn status by solving real-world problems with measurable business impact, not merely advancing academic research.

Valuation Multiples by AI Sector

AI startup valuation varies significantly across different artificial intelligence sectors. LLM vendors achieve the highest average revenue multiples at 44.1x, reflecting investor optimism about large language model commercialization potential. Computer vision, natural language processing, and robotics companies typically achieve lower but still premium multiples compared to traditional software businesses.

Machine learning valuation benchmarks show healthcare AI companies often command premium multiples due to regulatory barriers and significant market opportunities. Financial services AI startups achieve strong valuations through clear ROI demonstration and large addressable markets, while consumer AI applications face more challenging valuation environments due to competitive pressures.

Typical pre-money valuations range from $3.6 pre-seed to $795.2 Series C, providing clear benchmarks for AI startup valuation expectations across funding stages. However, exceptional companies with breakthrough technology or massive market opportunities can achieve valuations significantly above these medians.

Funding Round Dynamics

AI company valuation dynamics differ significantly across funding stages. AI startups often see valuation jumps based on technical milestones rather than traditional customer acquisition metrics. Early-stage valuations focus heavily on team quality, technology potential, and market opportunity, while later-stage rounds emphasize business model validation and path to profitability.

Artificial intelligence valuation in growth-stage funding rounds requires demonstrated unit economics and scalable revenue generation. Companies transitioning from research-focused organizations to commercial enterprises face valuation scrutiny around their ability to monetize AI capabilities effectively while maintaining competitive advantages.

The AI startup valuation environment in 2025 reflects increased sophistication among investors, with more emphasis on sustainable business models and less tolerance for purely speculative investments. However, companies with truly breakthrough capabilities continue to achieve extraordinary valuations that reflect their transformative potential.

Valuation Methods and Approaches

DCF Analysis for AI Companies

AI startup valuation through discounted cash flow analysis requires modifications to account for the unique characteristics of artificial intelligence businesses. Traditional DCF models must incorporate the capital-intensive nature of AI development, including ongoing computational costs, model retraining expenses, and infrastructure scaling requirements that differ significantly from conventional software companies.

Machine learning valuation via DCF analysis demands sophisticated revenue forecasting that accounts for technology adoption curves, competitive dynamics, and market penetration scenarios. AI companies often experience non-linear growth patterns as their technology achieves breakthrough performance levels or gains widespread market acceptance, requiring flexible modeling approaches.

AI company valuation using income-based methods involves building cash flow projections based on financial history, macroeconomic factors, and industry trends, then discounting projected cash flows to present value. However, many AI startups lack sufficient historical data, requiring greater reliance on comparable company analysis and market-based approaches.

Comparable Company Analysis

Startup valuation methods utilizing comparable company analysis face challenges in the AI sector due to the diverse applications and business models within artificial intelligence. This method involves comparing startups to similar companies that have recently been funded, adjusting average valuations based on management team strength, market size, technology, and business stage.

AI startup valuation through comparables requires careful selection of truly similar companies, considering technology focus, market application, business model, and competitive positioning. Companies developing large language models require different comparison sets than computer vision or robotics companies due to varying technical requirements and market dynamics.

Artificial intelligence valuation benchmarking becomes more reliable as the AI ecosystem matures and more companies achieve liquidity events. However, the rapid pace of technological advancement means that comparables can become outdated quickly, requiring constant updating of benchmark datasets and multiple validations.

Asset-Based Approaches

AI company valuation using asset-based approaches must account for both tangible and intangible assets unique to artificial intelligence companies. Tangible assets include specialized computing infrastructure, proprietary datasets, and custom hardware implementations. Intangible assets encompass intellectual property, trained models, algorithmic know-how, and talent value.

Machine learning valuation asset assessments require technical expertise to evaluate the quality and uniqueness of AI models, datasets, and intellectual property portfolios. The value of these assets depends on their competitive differentiation, commercial applicability, and sustainability over time as technology continues advancing.

AI startup valuation through asset-based methods often serves as a floor valuation rather than a primary methodology, as the highest-value AI companies derive most of their worth from future cash flow potential rather than current asset holdings. However, this approach provides important validation for companies with significant proprietary asset portfolios.

Strategic Considerations for Investors

Due Diligence Framework

AI startup valuation requires comprehensive technical due diligence beyond traditional business and financial analysis. Investors must evaluate algorithmic performance, data quality, technical team capabilities, and intellectual property strength to make informed valuation decisions. Technical due diligence often involves independent experts who can assess the viability and differentiation of AI technologies.

Artificial intelligence valuation due diligence includes evaluation of model reproducibility, training data provenance, computational efficiency, and scalability characteristics. Investors increasingly require demonstration of AI capabilities under real-world conditions rather than accepting laboratory or controlled environment results alone.

AI company valuation assessments must also consider regulatory compliance, ethical AI practices, and potential liability exposure from AI decision-making systems. As AI regulation evolves globally, companies with proactive compliance approaches may command valuation premiums relative to those facing regulatory risks.

Risk Assessment and Mitigation

AI startup valuation must account for technical, market, and execution risks unique to artificial intelligence ventures. Technical risks include model performance degradation, algorithmic bias issues, and competitive technology advancement. Market risks encompass adoption timing, regulatory changes, and competitive dynamics in rapidly evolving AI markets.

Machine learning valuation risk assessment requires an understanding of model limitations, edge case handling, and potential failure modes that could impact commercial viability. Companies with robust testing, validation, and monitoring systems typically receive higher valuations due to lower perceived technical risk.

AI company valuation risk mitigation involves diversification across multiple AI applications, robust intellectual property protection, and strong technical teams capable of adapting to technological changes. Investors favor companies with demonstrated ability to evolve their AI capabilities as the technology landscape continues advancing.

Investment Timing and Market Cycles

AI startup valuation varies significantly based on market cycles, investor sentiment, and broader economic conditions. The AI investment landscape has experienced periods of intense interest followed by more measured approaches as investors gain experience with artificial intelligence business models and their unique characteristics.

Artificial intelligence valuation timing considerations include technology maturity curves, competitive landscape evolution, and regulatory development timelines. Early-stage investors may capture higher returns by identifying breakthrough technologies before they achieve widespread recognition, while later-stage investors benefit from more proven business models with reduced execution risk.

AI company valuation optimization requires an understanding of investor preferences, market timing, and competitive positioning within funding cycles. Companies achieving significant milestones during favorable market conditions often secure higher valuations than similar companies raising capital during more challenging periods.

Future Outlook and Trends

Emerging Valuation Models

AI startup valuation methodologies continue evolving as the artificial intelligence industry matures and more companies achieve liquidity events. Emerging valuation models incorporate AI-specific metrics such as model accuracy improvements, computational efficiency gains, and data asset quality measurements that better reflect the unique value drivers of AI businesses.

Machine learning valuation innovations include real-time performance monitoring, competitive benchmarking platforms, and technical due diligence automation tools that provide more accurate and timely valuation insights. These developments enable more sophisticated investor decision-making and better capital allocation within the AI ecosystem.

AI company valuation trends indicate increased emphasis on sustainable business models, regulatory compliance, and ethical AI practices as valuation factors. Companies demonstrating responsible AI development and deployment practices may command premium valuations as investors and customers increasingly prioritize these considerations.

Market Maturation Impact

Artificial intelligence valuation expectations are becoming more grounded as the AI market matures and investors gain experience with artificial intelligence business models. Early speculative premiums are giving way to more traditional valuation methodologies that emphasize proven revenue generation, sustainable competitive advantages, and clear paths to profitability.

AI startup valuation benchmarks are stabilizing as more companies progress through complete funding cycles and achieve exit events. This increased data availability enables better comparable analysis and more accurate valuation modeling, reducing the uncertainty that characterized early AI investment periods.

The AI company valuation landscape is likely to become more differentiated as the market matures, with clear winners achieving premium valuations while companies without sustainable competitive advantages face more challenging valuation environments. This evolution reflects the natural maturation of a revolutionary technology sector.

More Read: How to Find and Invest in the Most Promising AI Startups

Conclusion

AI startup valuation has evolved into a sophisticated discipline that combines traditional financial analysis with deep technical evaluation and market opportunity assessment. The companies achieving billion-dollar valuations possess unique combinations of proprietary technology, valuable data assets, exceptional teams, and massive market opportunities. As the AI industry matures, valuation methodologies are becoming more nuanced, incorporating AI-specific metrics while maintaining focus on sustainable business models and competitive advantages.

Success in artificial intelligence valuation requires understanding the complex interplay between technical innovation, market dynamics, and execution capability that defines the most valuable AI companies. While speculative premiums may moderate over time, the transformative potential of artificial intelligence ensures that breakthrough companies will continue achieving extraordinary valuations that reflect their ability to reshape entire industries through AI innovation.