Why AI Startups Are Disrupting Traditional Industries Faster Than Ever

AI startups disrupting traditional industries through innovative technology, automation, and data-driven solutions. Discover how these companies.

The Disrupting Traditional Industries business landscape is experiencing an unprecedented transformation as AI startups emerge as powerful disruptors across traditional industries. Unlike previous technological revolutions that unfolded over decades, artificial intelligence startups are accelerating change at breakneck speed, fundamentally altering how businesses operate, compete, and serve customers. From healthcare and finance to manufacturing and retail, these innovative AI companies are not merely introducing new tools—they’re rewriting the rules of entire sectors.

What makes this disruption particularly remarkable is the scale and velocity of change. In 2024, AI companies captured over $100 billion in global VC funding, with U.S. private AI investment alone reaching $109.1 billion, demonstrating unprecedented investor confidence in AI-driven transformation. This massive capital infusion has enabled AI startups to rapidly scale their solutions and penetrate established markets with remarkable efficiency.

The current wave of AI disruption differs significantly from past technological shifts. While previous innovations required extensive infrastructure changes and lengthy adoption cycles, machine learning startups can deploy sophisticated algorithms that integrate seamlessly with existing systems, thereby reducing the need for significant infrastructure modifications. This accessibility allows them to challenge industry incumbents without the traditional barriers that once protected established players. Moreover, the democratization of AI tools and cloud computing has lowered entry barriers, enabling nimble startups to compete with billion-dollar corporations.

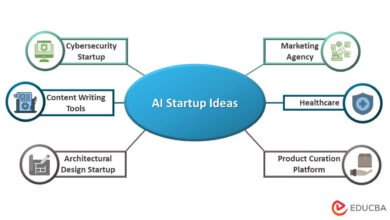

In 2025, artificial intelligence is no longer emerging—it’s foundational, powering over 6.2% of all global startups and accounting for nearly 9.2% of unicorns. This shift represents more than just technological advancement; it signals a fundamental reimagining of business models, customer expectations, and competitive dynamics. AI-powered startups are leveraging data analytics, automation, and predictive modeling to create solutions that are not only more efficient but also more personalized and responsive to market demands.

The implications of this rapid industry transformation extend beyond individual companies or sectors. As tech startups continue to integrate AI capabilities into their core operations, they’re creating ripple effects that force entire industries to evolve or risk obsolescence. This article explores the key factors driving this unprecedented pace of disruption and examines how AI startups are reshaping the business world faster than ever before.

The Current State of AI Startup Ecosystem

Funding and Investment Landscape

The AI startup ecosystem has experienced explosive growth, with venture capital funding reaching historic levels. Since the start of 2024, thousands of new AI companies have formed, and funding to AI companies has surpassed $170B, primarily driven by titans like OpenAI and Anthropic. This massive influx of capital has created a fertile environment for artificial intelligence startups to develop cutting-edge solutions and scale rapidly.

The funding landscape reveals a clear investor preference for AI-driven businesses. Traditional venture capital metrics are being redefined as investors recognize the transformative potential of machine learning startups. Unlike conventional tech investments that might focus on user acquisition or market share, AI startup valuations increasingly depend on data quality, algorithm sophistication, and the potential for automation across industries.

Market Penetration and Growth Rates

Disrupting Traditional Industries are achieving market penetration rates that far exceed historical benchmarks for technology adoption. The combination of cloud infrastructure, pre-trained models, and APIs has dramatically reduced the time-to-market for AI solutions. Tech startups can now deploy sophisticated AI capabilities within months rather than years, enabling them to capture market share before traditional competitors can respond effectively.

The growth trajectory of these companies defies conventional business models. Many AI-powered startups are experiencing exponential scaling due to the network effects inherent in machine learning systems. As their algorithms process more data, they become more accurate and valuable, creating a competitive advantage that compounds over time.

Key Factors Driving Accelerated Disruption

Technological Democratization

The democratization of AI technology has been a game-changer for startup innovation. Cloud computing platforms now offer sophisticated AI services that were once available only to tech giants. This accessibility allows emerging AI companies to leverage advanced capabilities without massive upfront investments in infrastructure or specialized talent.

Pre-trained models and APIs have further accelerated this democratization. AI startups can build upon existing foundations rather than starting from scratch, dramatically reducing development time and costs. This shift has enabled entrepreneurs to focus on application-specific innovations rather than fundamental algorithm development.

Reduced Barriers to Entry

Traditional industries often maintained high barriers to entry through regulatory requirements, capital intensity, or established distribution networks. Disrupting Traditional Industries is circumventing many of these barriers by offering software-based solutions that integrate with existing systems. This approach allows them to enter markets without the traditional infrastructure investments that once protected incumbent players.

The subscription-based software model has also lowered customer adoption barriers. Instead of requiring massive upfront investments, AI-powered startups can offer their solutions through accessible monthly or annual subscriptions, making it easier for traditional businesses to experiment with new technologies.

Data Advantage and Network Effects

Machine learning startups possess a unique advantage in their ability to improve continuously through data accumulation. Unlike traditional products that remain static after launch, AI-driven solutions become more valuable as they process more information. This creates powerful network effects where early adoption leads to better performance, attracting more users and generating more data.

The compound nature of these improvements means that AI startups can rapidly outpace competitors who rely on traditional development cycles. Each iteration of their algorithms can deliver measurably better results, creating a momentum that traditional companies struggle to match.

Industries Most Affected by AI Startup Disruption

Healthcare and Medical Technology

Healthcare represents one of the most dramatically transformed sectors by AI startups. Medical AI companies are revolutionizing everything from diagnostic imaging to drug discovery. These startups are developing solutions that can analyze medical images with accuracy that matches or exceeds specialist physicians, while doing so in a fraction of the time.

The impact extends beyond diagnostics to personalized treatment plans and predictive healthcare. AI-powered startups in healthcare are creating systems that can predict patient deterioration, optimize treatment protocols, and even discover new drug compounds. This transformation is particularly significant because healthcare has traditionally been slow to adopt new technologies due to regulatory requirements and patient safety concerns.

Financial Services and FinTech

The financial services industry has experienced perhaps the most visible disruption from AI startups. FinTech companies are leveraging machine learning for fraud detection, algorithmic trading, credit scoring, and personalized financial advice. These applications have proven so effective that traditional banks are either acquiring AI startups or partnering with them to remain competitive.

AI-native startups are pushing deeper into industry-specific workflows—automating insurance claims, legal briefings, and demonstrating how specialized AI applications are transforming even traditional financial processes. The speed and accuracy of AI-driven financial services have set new customer expectations that traditional institutions must meet to survive.

Legal Industry Transformation

A 2024 legal tech report found that approximately 39% of document review processes in large firms are now AI-assisted, with tools that can scan and extract relevant clauses, flag anomalies, and identify precedent cases far faster than junior associates or paralegals. This transformation illustrates how AI startups are not just improving existing processes but fundamentally changing the economic structure of professional services.

Legal AI companies are automating tasks that once required years of training and experience. Contract analysis, legal research, and document drafting are being revolutionized by startups that can deliver results in minutes rather than hours or days. This efficiency gain is forcing law firms to reconsider their business models and pricing structures.

Manufacturing and Supply Chain

AI startups in manufacturing are optimizing production processes, predicting equipment failures, and streamlining supply chains. These applications deliver immediate ROI through reduced downtime, improved quality control, and optimized resource allocation. The industrial applications of AI have proven particularly valuable because they directly impact bottom-line costs and operational efficiency.

Predictive maintenance solutions from AI-powered startups can anticipate equipment failures before they occur, potentially saving manufacturers millions in unplanned downtime. Similarly, AI-driven supply chain optimization can reduce inventory costs while improving delivery reliability.

Competitive Advantages of AI Startups Over Traditional Companies

Speed and Agility

AI startups possess inherent advantages in speed and agility that traditional companies struggle to match. Without legacy systems to maintain or established processes to navigate, these startups can implement new technologies and pivot strategies rapidly. This agility is particularly valuable in AI development, where the technology landscape evolves continuously.

The lean organizational structure typical of startup companies enables faster decision-making and implementation. While traditional corporations might require months of committee reviews and approval processes, AI startups can test, iterate, and deploy new solutions within weeks.

Data-First Approach

Unlike traditional companies that often treat data as a byproduct of operations, AI startups are built around data from inception. This fundamental difference in approach means their systems, processes, and business models are optimized for data collection, processing, and utilization. This data-centric foundation provides sustainable competitive advantages as its solutions improve automatically over time.

The ability to derive insights from data that traditional companies might overlook or underutilize represents a significant competitive moat. Machine learning startups can identify patterns and opportunities that human analysis might miss, leading to more effective strategies and better outcomes.

Technology Integration

AI-powered startups benefit from building their technology stack from the ground up with modern tools and architectures. This greenfield advantage allows them to avoid the technical debt that often hampers established companies. They can leverage the latest cloud services, AI frameworks, and development methodologies without constraints from legacy systems.

This technological foundation enables AI startups to scale more efficiently and adapt to new requirements more quickly than companies burdened with outdated infrastructure. The result is often superior performance and lower operational costs.

Investment Patterns and Funding Trends

Venture Capital Preferences

Venture capital firms have shifted their investment focus dramatically toward AI startups, recognizing the transformative potential and scalability of artificial intelligence solutions. The investment patterns reveal a preference for companies that can demonstrate clear AI advantages over traditional alternatives, rather than merely incorporating AI as a feature.

The most successful AI startup funding rounds are characterized by companies that can articulate specific use cases where AI provides measurable improvements in efficiency, accuracy, or cost reduction. Investors are particularly interested in startups that address large market opportunities with AI-native solutions rather than AI-enhanced versions of existing products.

Corporate Venture Capital and Strategic Investments

In 2025 and 2026, we expect to see a surge in M&A activity as incumbents move aggressively to buy their way into the AI era. This trend reflects traditional companies’ recognition that building AI capabilities internally may be slower and more expensive than acquiring innovative startups.

Corporate venture capital arms are increasingly active in the AI startup ecosystem, seeking both financial returns and strategic advantages. These investments often provide startups with valuable industry expertise, customer access, and distribution channels while giving corporations early exposure to cutting-edge technologies.

Geographic Distribution and Emerging Markets

The geographic distribution of AI startup funding reveals interesting patterns, with Silicon Valley maintaining its dominance while other regions emerge as significant players. European and Asian markets are producing innovative AI companies that challenge the traditional U.S. tech ecosystem, creating a more global competitive landscape.

Emerging markets present unique opportunities for AI startups to leapfrog traditional infrastructure and business models. In regions where established systems are less entrenched, AI-powered startups can often achieve faster adoption and greater impact than in mature markets.

Future Predictions and Market Outlook

Acceleration of Digital Transformation

The pace of industry disruption by AI startups is expected to accelerate further as digital transformation initiatives mature. In 2025, company leaders will no longer have the luxury of addressing AI governance inconsistently or in pockets of the business, as AI becomes intrinsic to operations and market offerings. This systematic integration will create new opportunities for AI startups while forcing traditional companies to adapt more rapidly.

The convergence of AI with other technologies like 5G, IoT, and edge computing will create new possibilities for startup innovation. These technological intersections will likely spawn entirely new categories of AI companies and business models that we can barely imagine today.

Regulatory Evolution and Compliance

As AI startups continue to disrupt traditional industries, regulatory frameworks will evolve to address new challenges and opportunities. This regulatory evolution will likely favor companies that build compliance and ethical considerations into their core operations from the beginning, giving thoughtful AI startups advantages over both reckless competitors and slow-moving incumbents.

The development of AI governance standards will create new market opportunities for AI-powered startups that specialize in compliance, monitoring, and risk management. These meta-AI solutions will become increasingly valuable as the AI ecosystem matures and regulatory requirements become more sophisticated.

Market Consolidation vs Continued Innovation

The AI startup ecosystem will likely experience both consolidation and continued fragmentation. While some markets will see dominant players emerge, the broad applicability of AI technology means new niches and applications will continue to create opportunities for emerging AI companies.

The key differentiator will be the ability to build defensible competitive advantages through data, algorithms, or market positioning. AI startups that can establish strong network effects or proprietary data sources will be best positioned to maintain their market position as the industry matures.

Challenges and Obstacles

Technical Challenges and Limitations

Despite their advantages, AI startups face significant technical challenges that can limit their disruptive potential. Data quality issues, algorithm bias, and scalability constraints can prevent even the most innovative solutions from achieving their full potential. The complexity of deploying AI systems in real-world environments often exceeds initial expectations.

Model interpretability and reliability remain critical challenges, particularly in regulated industries where AI companies must demonstrate how their systems make decisions. The “black box” nature of some AI algorithms can create adoption barriers in industries that require transparency and accountability.

Regulatory and Compliance Hurdles

AI startups entering highly regulated industries face complex compliance requirements that can slow deployment and increase costs. Healthcare, finance, and other regulated sectors have established safety and compliance standards that AI solutions must meet before gaining market acceptance.

The evolving nature of AI regulation creates uncertainty for startup companies trying to build compliant solutions. Regulatory frameworks that lag behind technological development can create ambiguous requirements that are difficult and expensive to navigate.

Market Adoption and Customer Education

Traditional industries often exhibit resistance to change, particularly when new technologies threaten established processes or job roles. AI startups must invest significantly in customer education and change management to overcome this resistance. The complexity of AI solutions can make it difficult for potential customers to understand and evaluate their benefits.

Building trust in AI systems requires demonstrating reliability and performance over time. AI-powered startups must often prove their solutions through extensive pilot programs and gradual implementations rather than rapid wholesale adoption.

More Read: AI Meets IoT: Driving Smarter Homes, Cities, and Industries

Conclusion

AI startups are disrupting traditional industries at an unprecedented pace due to a convergence of factors, including democratized technology access, massive venture funding, reduced barriers to entry, and inherent data advantages that create powerful network effects. With artificial intelligence now foundational rather than emerging, powering over 6.2% of all global startups and 9.2% of unicorns, these companies are fundamentally reshaping business models across healthcare, finance, legal services, and manufacturing through solutions that are more efficient, accurate, and scalable than traditional alternatives.

The combination of cloud infrastructure, pre-trained models, and data-first approaches enables AI-powered startups to achieve market penetration rates that far exceed historical benchmarks, while their agile structures allow rapid iteration and deployment that traditional corporations struggle to match. As regulatory frameworks evolve and corporate acquisition activity increases, the most successful AI companies will be those that build defensible competitive advantages through proprietary data, superior algorithms, and strong network effects, positioning them to continue driving industry transformation at an accelerating pace throughout 2025 and beyond.