Enterprise AI Startups vs Consumer AI Which Is Winning

Explore the battle between enterprise AI startups and consumer AI in 2025. Discover market trends, funding dynamics, and which sector.

The artificial intelligence revolution is reshaping technology markets at unprecedented velocity, creating two distinct battlegrounds: the enterprise AI startup ecosystem and the burgeoning consumer AI sector. Understanding which segment is winning requires examining multiple dimensions—market size, growth rates, funding dynamics, adoption patterns, and profitability trajectories. The consumer AI market, despite reaching 1.7–1.8 billion users in just 2.5 years, currently converts only about 3% of users into paying subscribers, compared to enterprise AI spending that reached $13.8 billion in 2024. The narrative emerging from 2025 market data reveals a nuanced competition where neither segment is comprehensively “winning,” but rather, they’re engaging in distinct competitive dynamics with fundamentally different value propositions. Strong consumer brands like ChatGPT are translating into strong enterprise demand, with much of the early growth across leading enterprise AI apps driven by the prosumer market. This cross-pollination effect complicates traditional competitive analysis: companies initially conceived as consumer AI applications like ChatGPT and Cursor are capturing enterprise budgets, while purpose-built enterprise AI startups focus on vertical-specific solutions delivering measurable ROI within months. The enterprise AI market is projected to reach approximately $150-170 billion by 2030, while the consumer AI market is forecasted to grow from $92.24 billion in 2024 to $674.49 billion by 2030, suggesting that consumer AI’s revenue potential ultimately exceeds enterprise AI’s, despite the latter’s current financial prominence. This comprehensive analysis examines market dynamics, funding patterns, product strategies, and adoption behaviors to determine which AI startup category is truly winning the competitive race for technological dominance and commercial success in the rapidly evolving artificial intelligence landscape.

Market Size and Growth Comparison

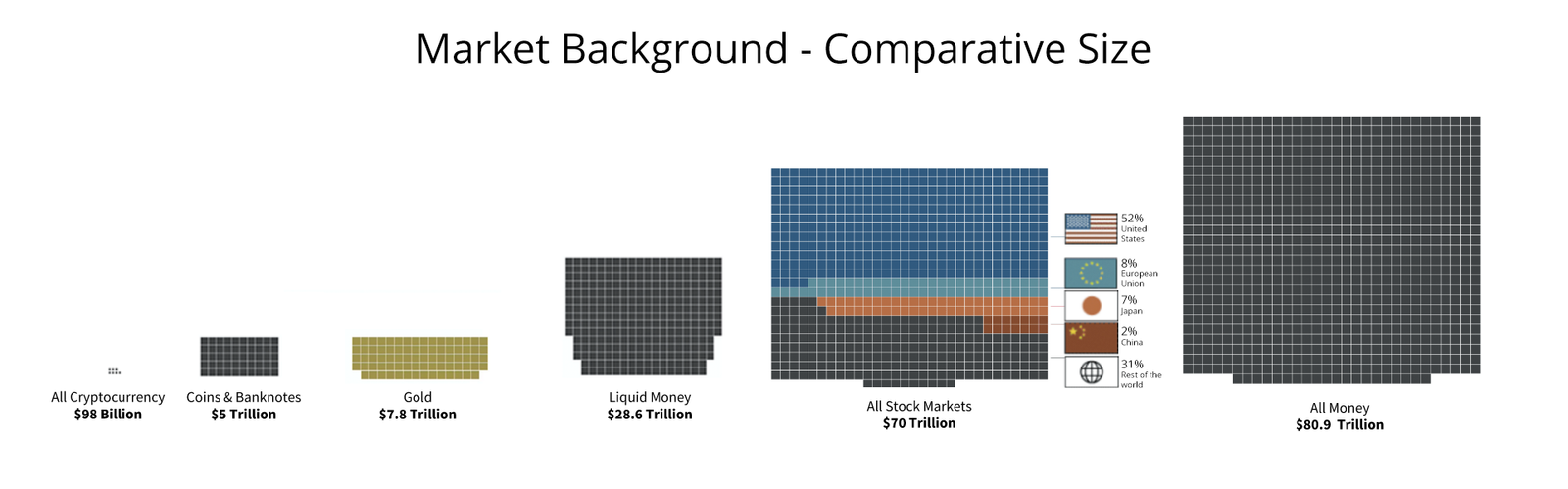

The enterprise AI market shows annual growth rates of 30–40%, with forecasts projecting the market will reach well over $100 billion within a few years, potentially reaching $150-170 billion by 2030 or 2031. The enterprise AI market growth has accelerated dramatically, particularly as organizations recognize AI’s capacity to drive operational efficiency, cost reduction, and competitive advantage. According to the Census Bureau’s Business Trends and Outlook Survey, AI adoption among US firms has more than doubled in the past two years, rising from 3.7% in fall 2023 to 9.7% in early August 2025, indicating that enterprise AI adoption remains in early innings despite visible acceleration.

By contrast, the consumer AI market size was valued at USD 92.24 billion in 2024 and is projected to reach USD 674.49 billion with a CAGR of 28.3% from 2025-2030. While the consumer AI market growth rate appears slightly lower than enterprise AI’s percentage CAGR, the absolute revenue multiplier is substantially larger: consumer AI is projected to expand approximately 7.3 times in five years, versus enterprise AI’s likely 2-3x expansion over the same period. This disparity reflects fundamentally different monetization challenges: while consumer AI reached massive user bases, the $432 billion annual opportunity at $20 monthly subscription rates per user represents only 3% conversion today, indicating one of the largest monetization gaps in recent consumer technology history. This suggests that while the consumer AI market size appears smaller today, its total addressable market (TAM) potentially exceeds enterprise AI by several multiples.

Enterprise AI Startups: The B2B Powerhouse

Enterprise AI startups have captured extraordinary attention from venture capital investors and strategic acquirers. Hitting $1 million in ARR in the first 12 months of monetization used to be a classic benchmark for enterprise startups to raise a successful Series A, but based on the sample set of Series A AI companies seen over the last 18 months, that’s now below the median, with fastest fastest-growing AI software companies growing more than 10x year over year. This acceleration reflects profound shifts in enterprise purchasing behavior: organizations now maintain dedicated AI budgets and exhibit eagerness to deploy artificial intelligence solutions that demonstrably reduce costs or enhance revenue.

The enterprise AI startup category encompasses diverse business models. Companies like Cursor have become one of the fastest-growing software companies of all time through product-led go-to-market strategies, while companies like Decagon, ElevenLabs, Hebbia, and Harvey have leveraged early momentum to establish premier enterprise brands, compounding customer momentum in their respective markets. These AI-native startups distinguish themselves through laser-focused specialization: rather than attempting to serve all enterprises with general-purpose tools, they address specific vertical problems—legal review automation, code completion, voice cloning, or enterprise search—with exceptional depth.

A critical competitive advantage for enterprise AI companies is their resistance to disruption from incumbents. Despite Microsoft offering GitHub Copilot and OpenAI offering Codex for coding tasks, Cursor has sustained market leadership through superior product velocity and focused innovation. Incumbents often split their focus across their core legacy business or their many competing research and product priorities, and as a result, AI-native startups that stay laser-focused remain ahead of the curve against legacy incumbents and the model providers. This dynamic suggests that B2B AI startups benefit from organizational agility that large enterprises simply cannot replicate.

Consumer AI: Viral Growth and Profitability Paradox

The consumer AI market represents an entirely different competitive paradigm. Ninety-one percent of AI users reach for their favorite general AI tool for nearly every job, with generalist platforms dominating due to first-mover advantage and built-in distribution. This “default behavior” consolidates enormous market share toward incumbent platforms—particularly OpenAI’s ChatGPT and Google’s Gemini—rather than enabling fragmented competition among specialized tools.

Yet within the consumer AI space, explosive growth opportunities persist for specialized applications. Explosive growth stories like Cursor’s jump to a $500M+ run rate in just two years, and website builders like Lovable reaching over $60 million in ARR in under a year, demonstrate strong task-technology fit in consumer-facing AI applications. These successes indicate that, despite consumer AI’s general tendency toward monolithic platforms, specialized consumer AI tools can achieve remarkable commercial success by solving specific problems—coding assistance, website building, image generation—with exceptional quality.

The consumer AI monetization challenge remains profound. At an average monthly subscription cost of $20 per month across 1.8 billion users, the theoretical annual opportunity equals $432 billion, yet today’s $12 billion market indicates only about 3% conversion into paid services, with even ChatGPT converting only about 5% of its weekly active users into paying subscribers. This monetization gap represents simultaneously the sector’s greatest weakness and greatest opportunity: consumer AI companies that successfully solve subscription conversion or alternative monetization models (advertising, data licensing, enterprise licensing) will capture extraordinary value.

Funding Dynamics and Capital Allocation

The venture capital ecosystem reveals telling patterns about which AI sector investors believe is winning. In 2024 alone, venture capital funding into AI startups exceeded $100 billion, marking one of the largest surges in technology funding in history. However, the allocation of this capital between enterprise AI startups and consumer AI companies reflects sophisticated investor belief systems about market potential and defensibility.

A new a16z report shows OpenAI tops AI spending by startups, with consumer AI tools increasingly adopted by enterprises, with 70% not requiring enterprise licenses, indicating how consumer products are more powerful than ever while being able to serve enterprise use cases simultaneously. This data reveals a fascinating dynamic: startups themselves are adopting consumer AI tools at enterprise scale, blurring the traditional boundaries between consumer AI and enterprise AI. The implication is profound—consumer-first products, when sufficiently powerful, naturally attract enterprise adoption without requiring separate enterprise-focused engineering.

The “GenAI Divide” and Enterprise Implementation Reality

Despite enthusiasm for enterprise AI deployment, research reveals significant barriers to successful scaling. Enterprises defined as firms with over $100 million in annual revenue lead in pilot count and allocate more staff to AI-related initiatives, yet this intensity has not translated into success, with these organizations reporting the lowest rates of pilot-to-scale conversion, while mid-market companies moved faster and more decisively, with top performers reporting average timelines of 90 days from pilot to full implementation. This “GenAI Divide” suggests that enterprise AI adoption faces significant organizational barriers unrelated to technology quality, including change management, workflow integration, and organizational structure challenges.

Furthermore, a striking discrepancy exists between official enterprise adoption and “shadow AI” usage. While only 40% of companies say they purchased an official LLM subscription, workers from over 90% of the companies surveyed reported regular use of personal AI tools for work tasks. This phenomenon indicates that employees are voluntarily adopting consumer AI tools and bringing them into enterprise settings without formal procurement, suggesting that consumer AI products better match actual user needs than enterprise-engineered alternatives.

Cross-Sector Convergence: Consumer AI Infiltrating Enterprises

Perhaps the most significant competitive dynamic is the convergence between consumer and enterprise segments. Strong consumer brands are translating into strong enterprise demand, like some of the early platform shifts, with much of the early growth across leading enterprise AI apps driven by the prosumer market, kickstarted by ChatGPT and underscored by coding apps and creator tools like ElevenLabs, as many CIOs noted their decision to purchase enterprise ChatGPT was driven by employees loving ChatGPT and its brand recognition. This pattern demonstrates that the traditional distinction between consumer AI and enterprise AI is dissolving—consumer-grade tools with sufficient power and reliability naturally graduate to enterprise deployment without requiring specialized engineering.

This dynamic creates a critical competitive moat for consumer-first AI companies: by building for consumers’ desires first, they simultaneously create enterprise demand through bottom-up adoption. Companies like Cursor exemplify this strategy: initially conceived as a coding productivity tool for individual developers, it has attracted enterprise adoption simply through superior product quality and alignment with developer workflows.

Profitability and Path to Sustainability

The enterprise AI startup sector currently demonstrates clearer paths to profitability. Enterprise buyers are still human, and trusted relationships often matter more than any specific feature or vendor price, with many AI companies now having the buyer’s ear in ways traditional software vendors rarely did, helping shape customer roadmaps and AI strategy, not just tool purchases. This relationship-based competitive advantage suggests that enterprise AI companies enjoy defensible customer relationships that create switching costs, supporting sustainable premium pricing.

The consumer AI market, by contrast, faces structural monetization challenges. With free tiers cannibalizing paid conversion and consumer expectations for exceptional functionality at low cost, consumer AI profitability remains elusive for most market participants. OpenAI, despite ChatGPT’s dominance, has not achieved consistent profitability despite extraordinary valuations and funding. This suggests that consumer AI monetization requires novel approaches beyond traditional subscription models—potentially including enterprise licensing, API revenue, or alternative models like advertising or data licensing.

Vertical AI Within Enterprise: Specialized Opportunity

An important subcategory within enterprise AI startups involves vertical-specific solutions. Rather than building general-purpose enterprise AI platforms, these companies embed artificial intelligence directly into industry-specific workflows: legal review, financial analysis, healthcare diagnostics, or supply chain optimization. The standout performers are not those building general-purpose tools, but those embedding themselves inside workflows, adapting to context, and scaling from narrow but high-value footholds. This vertical strategy appears to generate superior business outcomes compared to horizontal approaches, suggesting that industry-specific AI startups are winning within the enterprise segment.

Competitive Responses from Tech Giants

Large incumbent technology companies have responded defensively to competition from both enterprise AI startups and consumer AI competitors. Incumbents have always benefited from established trust and existing distribution, but in the AI era, they’re increasingly outperformed by AI-native competitors from a product quality and velocity perspective, with the primary reason buyers prefer AI-native vendors being their faster innovation rate. This represents a significant departure from historical technology competition patterns, where incumbents’ distribution and customer relationships typically enabled them to defend market position despite product quality gaps.

Microsoft, Google, Amazon, and other hyperscalers are simultaneously developing generative AI capabilities while integrating acquisitions and partnerships with specialized AI companies. This “acquire or integrate” strategy indicates that incumbents believe AI-native startups possess defensible advantages that cannot be easily replicated internally, validating the competitive viability of focused enterprise AI startups and consumer AI applications.

Which Is Winning? A Nuanced Assessment

The answer to “which is winning” depends fundamentally on how one defines “winning.” By revenue metrics, enterprise AI currently dominates with $13.8 billion in spending versus approximately $12 billion in consumer AI revenue. However, by growth rate, total addressable market potential, and future revenue trajectory, consumer AI demonstrates a substantially larger opportunity. By profitability, enterprise AI companies show clearer near-term paths to sustainable business models, while consumer AI remains largely unprofitable despite massive scale.

By innovation velocity and product quality, specialized AI-native startups in both consumer and enterprise segments are outpacing incumbents, suggesting that agile, focused companies are winning competitive battles despite their smaller scale. By real-world impact and voluntary adoption patterns, consumer-first products appear to be winning—employees voluntarily adopting consumer AI tools indicate superior product-market fit compared to enterprise-engineered alternatives.

The emerging pattern suggests that both sectors are “winning” simultaneously, but in different ways: enterprise AI startups are winning business model and defensibility battles, while consumer AI applications are winning product quality and adoption velocity battles. The true winner may ultimately be the hybrid companies capable of excelling in both domains simultaneously—consumer-first products that enjoy enterprise-grade reliability and vertical specialization.

More Read: AI Startups Solving Real Problems in Healthcare

Conclusion

The competition between enterprise AI startups and consumer AI reveals that victory depends on the metrics examined and the timeframe considered. The market now looks more like traditional software yet moves with the speed and complexity unique to AI, with enterprises increasingly comfortable mixing and matching multiple models to optimize across both performance and cost. Currently, enterprise AI startups generate larger revenues and demonstrate clearer profitability paths, while consumer AI companies boast exponentially larger user bases and superior long-term market growth projections.

The most significant competitive dynamic is the convergence of these sectors—consumer-first products that reach sufficient quality levels naturally attract enterprise deployment without requiring specialized engineering, while AI-native startups across both segments are consistently outpacing incumbent technology vendors through superior innovation velocity. Rather than a winner-take-all dynamic, the future AI landscape appears to feature the coexistence of specialized vertical enterprise AI platforms, dominant general-purpose consumer tools capturing massive user bases, and hybrid companies successfully bridging both categories.

Investors, founders, and enterprises should recognize that the dichotomy between consumer and enterprise AI is dissolving—success increasingly depends on building exceptional products that solve genuine user needs, then leveraging that product quality to capture additional markets, whether consumer-to-enterprise or vice versa. The next five years will reveal whether consumer AI’s size advantage and enterprise AI’s profitability advantage ultimately determine market dominance, or whether the true victors are hybrid companies that refuse to accept traditional categorical constraints.