From Idea to IPO The AI Startup Journey Explained

AI Startup Journey Explained from initial idea to IPO. Learn funding stages, venture capital strategies, and growth tactics for successful

AI Startup Journey Explained landscape has transformed dramatically, with AI startups raising $104.3 billion in the U.S. in the first half of this year, nearly matching the $104.4 billion total for 2024. This unprecedented growth highlights the immense opportunities within the AI startup ecosystem, where innovative entrepreneurs are turning groundbreaking ideas into billion-dollar enterprises.

Navigating the startup journey from concept to initial public offering (IPO) requires a deep of multiple critical stages, each presenting unique challenges and opportunities. The AI startup funding landscape has evolved into a sophisticated ecosystem where venture capital firms are increasingly focused on identifying and nurturing the next generation of artificial intelligence leaders.

Today’s AI entrepreneurs must master not only the technical aspects of artificial intelligence but also the complex business dynamics of scaling a technology startup. The journey encompasses everything from validating your AI business idea to securing multiple rounds of startup funding, building scalable AI solutions, and ultimately preparing for a successful public offering.

The AI startup landscape in 2025 is characterized by intense competition, massive funding opportunities, and rapid technological advancement. By the end of 2025, it’s projected to reach nearly $400 billion, reflecting both the appetite of investors for AI-driven solutions. This environment demands strategic thinking, operational excellence, and a clear of how to navigate each phase of the startup growth process.

The Complete AI Startup Journey Explained is essential for aspiring entrepreneurs who want to build sustainable, scalable businesses that can compete in today’s dynamic market. This comprehensive guide will walk you through every stage of the process, from initial ideation to achieving a successful IPO exit.

The Genesis: From AI Business Idea to Concept Validation

Identifying Market Opportunities in an AI Startup Journey Explained

The foundation of every successful AI startup begins with identifying genuine market opportunities where artificial intelligence can solve real-world problems. Today’s AI entrepreneurs must look beyond the hype and focus on areas where AI solutions can deliver measurable value. Key sectors experiencing significant growth include healthcare diagnostics, autonomous systems, financial services, and enterprise automation.

Market research is crucial during this phase, as it helps validate whether your AI business idea addresses a genuine pain point or simply represents a solution in search of a problem. Successful artificial intelligence startups typically emerge from founders who have deep domain expertise combined with technical AI knowledge, allowing them to identify opportunities that others might miss.

The most promising AI startup ideas often emerge at the intersection of technological capability and market demand. Entrepreneurs should focus on areas where current solutions are inadequate, expensive, AI Startup Journey Explained or completely absent. This approach increases the likelihood of creating a defensible market position and attracting venture capital interest.

Concept Development and Technical Feasibility

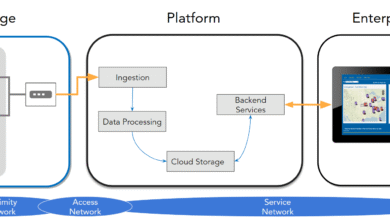

Once you’ve identified a potential opportunity, the next step involves developing your concept and assessing technical feasibility. This phase requires a thorough of current AI capabilities, limitations, and the resources needed to build your AI solution. Many AI Startup Journey Explained fail because they underestimate the complexity of implementing artificial intelligence at scale.

During concept development, it’s essential to define your minimum viable product (MVP) and identify the core AI technologies that will power your solution. This includes determining whether you’ll need machine learning, AI Startup Journey Explained natural language processing, computer vision, or other AI specializations. The technical architecture decisions made during this phase will significantly impact your startup’s ability to scale and attract investment.

Successful AI entrepreneurs also consider the data requirements for their solutions early in the development process. Access to high-quality training data often determines the success or failure of AI applications, making data strategy a critical component of your overall business plan.

Building Your MVP and Early Validation

Creating an effective MVP for an AI startup requires balancing functionality with resource constraints. Your initial product should demonstrate the core value proposition while being simple enough to develop quickly and cost-effectively. This approach allows you to validate your concept with real users before investing significant resources in full-scale development.

Early validation involves testing your AI solution with potential customers to gather feedback and iterate on your approach. This process helps refine your product-market fit and provides valuable insights that will be crucial when approaching investors for funding. Many successful AI startups pivot significantly during this phase based on user feedback and market learning.

The validation process should also include technical benchmarking to ensure your AI system performs competitively against existing solutions. This data becomes essential when pitching to venture capital firms and demonstrating the technical superiority of your approach.

Securing Seed Funding: The First Investment Milestone

AI Startup Funding Landscape

The AI startup funding environment has become increasingly competitive, with U.S.-based AI startups continue to rake in venture funding with multiple companies already raising impressive rounds in 2025. this landscape is crucial for successfully raising your first round of capital. Seed funding for AI Startup Journey Explained typically ranges from $500,000 to $5 million, AI Startup Journey Explained depending on the complexity of your solution and market opportunity.

Angel investors and early-stage venture capital firms are particularly interested in AI startups that demonstrate clear technical differentiation and large market opportunities. The key to successful fundraising lies in articulating how your AI solution creates unique value and why now is the right time to build your company.

Investors also scrutinize the team’s ability to execute on their vision. AI Startup Journey Explained with founders who have relevant technical expertise and industry experience typically find it easier to secure funding. Building a strong advisory board with recognized experts in your field can significantly enhance your credibility with potential investors.

Preparing for Investor Pitches

Creating a compelling pitch for an AI Startup Journey Explained investment requires balancing technical details with business fundamentals. Your presentation should clearly explain the problem you’re solving, your AI solution’s unique approach, and the size of the market opportunity. Investors want to understand both the technology and the business model that will generate returns.

Technical demonstrations are particularly important for AI startups. Live demos that show your technology working on real problems can be far more convincing than theoretical explanations. However, it’s crucial to manage expectations and be honest about current limitations and development timelines.

Financial projections for AI Startup Journey Explained should account for the unique cost structure of artificial intelligence businesses, including data acquisition, computing resources, and specialized talent. Investors expect to see a clear path to profitability and scalable unit economics.

Navigating Due Diligence Process

The due diligence process for AI startups is often more complex than for traditional technology companies. Investors will scrutinize your intellectual property, data assets, technical architecture, and team capabilities. Having proper documentation and legal protections in place before starting fundraising can significantly accelerate this process.

Technical due diligence may involve code reviews, architecture assessments, and performance evaluations. Some venture capital firms employ technical experts specifically to evaluate AI Startup Journey Explained, so it’s important to be prepared for detailed technical discussions.

Legal due diligence for AI companies also includes reviewing data usage rights, privacy compliance, and potential regulatory issues. As AI regulation evolves, investors are increasingly focused on companies that proactively address compliance and ethical considerations.

Series A and Beyond: Scaling Your AI Venture

Building the Team and Infrastructure AI Startup Journey Explained

Successful scaling of an AI Startup Journey Explained requires assembling a world-class team across multiple disciplines. Beyond core technical talent, growing AI companies need expertise in product management, sales, marketing, and operations. The competition for top AI talent is intense, making recruitment strategy a critical component of your startup growth plan.

Infrastructure scaling for AI startups involves significant technical challenges, including managing large datasets, computational resources, and model deployment at scale. Cloud computing costs can escalate quickly as your AI solution gains traction, making cost optimization and infrastructure planning essential for maintaining healthy unit economics.

Building robust MLOps (Machine Learning Operations) capabilities becomes crucial as your AI startup scales. This includes automated model training, testing, deployment, and monitoring systems that ensure consistent performance and reliability as you serve more customers.

Product Development and Market Expansion

Series A funding provides the resources needed to accelerate product development and expand into new markets. For AI startups, this phase often involves enhancing your core algorithms, adding new features, and improving user experience based on customer feedback and usage data.

Market expansion strategies for AI companies should consider both horizontal expansion (new use cases) and vertical expansion (deeper penetration within existing markets). The choice between these approaches depends on your technology’s applicability and competitive landscape.

Customer success becomes increasingly important as you scale your AI startup. Unlike traditional software, AI solutions often require ongoing optimization and customization for different use cases. Building strong customer success capabilities ensures high retention rates and provides opportunities for expansion revenue.

Strategic Partnerships and Ecosystem Development

Partnerships play a crucial role in scaling AI startups efficiently. Strategic alliances with established companies can provide access to customers, distribution channels, and complementary technologies. Many successful AI companies have leveraged partnerships to accelerate growth while conserving capital.

Ecosystem development involves building relationships with other technology companies, research institutions, and industry organizations. These connections can provide access to talent, customers, and emerging opportunities that might not be available through traditional channels.

Integration partnerships are particularly valuable for AI startups serving enterprise customers. By integrating with existing enterprise software platforms, you can reduce adoption barriers and accelerate customer onboarding.

Growth Stage Funding: Series B, C and Pre-IPO Rounds

Advanced Funding Strategies

As your AI startup demonstrates product-market fit and scalable growth, growth stage funding becomes available from larger venture capital firms and growth equity investors. These rounds typically range from $10 million to over $100 million, providing the capital needed for aggressive expansion and market leadership.

Growth stage investors focus heavily on metrics that demonstrate scalable business models, including recurring revenue, customer acquisition costs, lifetime value, and market expansion potential. For AI Startup Journey Explained, additional metrics around model performance, data network effects, and competitive moats become particularly important.

The venture capital landscape for growth-stage AI companies includes both traditional VC firms and specialized AI-focused investors. Each type brings different value beyond capital, including industry expertise, customer connections, and operational support.

International Expansion and Market Leadership

Growth stage AI startups often pursue international expansion to capture larger market opportunities and establish global market leadership. This expansion requires different regulatory environments, cultural preferences, and competitive landscapes across multiple markets.

International expansion for AI companies also involves technical considerations, including data localization requirements, latency optimization, and compliance with varying privacy regulations. These factors can significantly impact architecture decisions and operational complexity.

Market leadership strategies for mature AI startups often include strategic acquisitions of complementary technologies, talent, or customer bases. These acquisitions can accelerate growth and strengthen competitive positioning ahead of an eventual IPO.

Building IPO Readiness

Preparing for an initial public offering requires establishing the governance, financial controls, and operational processes expected of public companies. This preparation often begins 18-24 months before the actual IPO, involving significant investments in finance, legal, and compliance capabilities.

Financial reporting for AI companies going public requires clear articulation of revenue recognition policies, especially for usage-based pricing models common in the AI industry. Investors need to understand how your business generates revenue and the sustainability of your growth model.

Corporate governance for AI startups preparing for IPO also involves establishing proper risk management processes, especially around data privacy, algorithmic bias, and regulatory compliance. These factors are increasingly important for public market investors evaluating AI companies.

The IPO Journey: Going Public in the AI Era

Market Timing and Valuation Considerations

Timing your IPO correctly can significantly impact your company’s public market success. Some AI startups are itching to finally go public; other tech startups that are just ‘AI-adjacent’ are hoping the tech can boost their share prices. Market conditions, investor sentiment toward AI stocks, and your company’s financial performance all influence optimal timing.

Valuation for AI companies in public markets often involves complex considerations around growth potential, competitive positioning, and technology differentiation. Public market investors may value AI Startup Journey Explained differently than private investors, focusing more on sustainable business models and less on pure technology potential.

The IPO process for AI companies requires extensive preparation, including financial audits, regulatory filings, and investor education about your technology and market opportunity. Investment banks specializing in technology IPOs can provide valuable guidance throughout this process.

Regulatory Compliance and Governance

AI companies going public face increasing scrutiny around ethical AI practices, data governance, and algorithmic transparency. Establishing robust compliance frameworks and governance structures is essential for maintaining public market confidence and avoiding regulatory issues.

Board composition for public AI companies should include directors with relevant technology expertise, regulatory knowledge, and public company experience. This expertise becomes crucial for navigating the complex regulatory environment facing AI businesses.

Risk management for public AI companies involves identifying and mitigating technology-specific risks, including data breaches, algorithmic failures, and regulatory changes. These risks must be clearly disclosed to public market investors and actively managed through appropriate controls and procedures.

Post-IPO Growth and Long-term Success

Success as a public AI company requires balancing growth investments with profitability expectations from public market investors. This balance can be challenging for AI startups accustomed to prioritizing growth over short-term profitability.

Public AI companies must also manage investor expectations around technology development timelines and market opportunities. Clear communication about your AI roadmap and competitive strategy helps maintain investor confidence and stock price stability.

Long-term success for public AI companies often involves continued innovation, strategic acquisitions, and expansion into adjacent markets. These strategies help maintain growth rates and competitive positioning in the rapidly evolving artificial intelligence landscape.

Key Success Factors Throughout the Journey

Technical Excellence and Innovation

Maintaining technical leadership throughout the startup journey requires continuous investment in research and development. AI companies must stay ahead of rapidly evolving technologies while building practical solutions that deliver customer value. This balance between innovation and execution is crucial for long-term success.

Intellectual property strategy becomes increasingly important as AI Startup Journey Explained grow and face competition. Building a strong patent portfolio and protecting trade secrets helps create defensive moats and licensing opportunities that enhance company value.

Technical talent retention is critical for AI startups throughout their journey. Competition for skilled AI professionals is intense, making employee equity programs, challenging technical problems, and strong company culture essential for maintaining your technical edge.

Building Sustainable Business Models

Successful AI startups develop sustainable business models that can support long-term growth and profitability. This often involves evolving from initial consulting or custom development work toward scalable product offerings that can serve multiple customers efficiently.

Pricing strategy for AI solutions requires careful consideration of value creation, competitive positioning, and customer economics. Many AI companies use usage-based pricing models that align costs with value delivered, though this requires sophisticated metering and billing capabilities.

Customer concentration risk is a common challenge for AI startups, especially those serving enterprise markets. Building a diversified customer base reduces risk and creates more predictable revenue streams that investors value highly.

Strategic Vision and Execution

Long-term strategic vision helps AI entrepreneurs make consistent decisions throughout the startup journey. This vision should balance ambitious goals with practical execution steps, providing clear direction for team members and investors.

Execution excellence involves building operational capabilities that can scale with business growth. This includes establishing proper financial controls, operational metrics, and management processes that support efficient scaling.

Adaptability is essential for AI startups operating in rapidly changing markets. Successful companies maintain strategic focus while remaining flexible enough to pivot when market conditions or competitive dynamics change.

Common Pitfalls and How to Avoid Them

Technical and Product Challenges

Many AI startups underestimate the complexity of productizing research-quality algorithms. The gap between proof-of-concept demonstrations and production-ready systems is often larger than expected, requiring significant additional development time and resources.

Data quality issues can severely impact AI startup success. Poor training data leads to unreliable models, while insufficient data access can limit your solution’s effectiveness. Establishing robust data pipelines and quality controls from the beginning prevents costly problems later.

Over-engineering is common among AI startups led by technical founders. Building overly complex solutions can slow development, increase costs, and make it difficult to achieve product-market fit. Focusing on solving specific customer problems rather than building general AI platforms often leads to better outcomes.

Business and Market Mistakes

Market timing mistakes can doom otherwise excellent AI Startup Journey Explained. Entering markets too early (before customer demand exists) or too late (after competition is entrenched) significantly impacts success probability. Careful market analysis and customer validation help avoid these timing errors.

Fundraising mistakes include raising too little capital (limiting growth potential) or too much capital (creating unrealistic expectations). your capital requirements and growth plans helps optimize fundraising timing and amounts.

Team scaling challenges often emerge as AI Startup Journey Explained grow rapidly. Hiring too quickly can create cultural problems and inefficiencies, while hiring too slowly can limit growth potential. Building strong recruiting and onboarding processes helps manage this balance.

Regulatory and Ethical Considerations

Ignoring regulatory compliance can create significant risks for AI Startup Journey Explained. As AI regulation evolves, companies that proactively address compliance requirements gain competitive advantages over those that treat regulation as an afterthought.

Ethical AI considerations are increasingly important for AI companies throughout their journey. Building fair, transparent, and accountable AI systems not only reduces regulatory risk but also builds trust with customers and investors.

Privacy and security issues can severely damage AI Startup Journey Explained prospects. Implementing robust data protection and security measures from the beginning prevents costly breaches and regulatory violations that could derail your company’s growth.

More Read: http://AI Startup Journey Explained

Conclusion

The AI Startup Journey Explained from idea to IPO represents one of the most challenging yet rewarding paths in modern entrepreneurship. With AI startups raising $104.3 billion in the U.S. in the first half of this year, the opportunities for building successful artificial intelligence companies have never been greater. Success requires mastering technical excellence, business fundamentals, and strategic execution across multiple growth stages.

AI entrepreneurs who understand the complete journey—from initial concept validation through venture capital funding rounds to eventual public offering—position themselves for sustainable success in this dynamic and rapidly growing market. The key lies in balancing innovation with execution, maintaining strategic focus while remaining adaptable, and building sustainable business models that create genuine value for customers, investors, and society.