How AI Startups Get Funded What Investors Look For

Learn how AI startups secure funding and what venture capital investors prioritize. Discover key metrics, investor types, and strategies for raising.

The AI startup funding landscape has undergone a seismic transformation, becoming the most dominant investment category in venture capital with unprecedented capital flowing into companies building artificial intelligence solutions. In 2025, AI startups have attracted $192.7 billion in global venture capital, representing 52.5% of all VC funding and cementing artificial intelligence as the defining technology of this investment era. This explosive growth represents more than triple the investment levels from just a few years ago, fundamentally reshaping how venture capitalists allocate capital and what founders must understand to succeed. The AI funding environment differs dramatically from previous technology cycles—investors are no longer betting on speculative technologies but rather on companies already demonstrating real traction, measurable market validation, and sustainable business models capable of generating substantial returns.

How AI startups get funded requires looking beyond headline numbers to examine the underlying criteria, investor psychology, and strategic considerations shaping modern venture capital decisions. While $192.7 billion might seem like limitless capital, the funding reality reveals a more nuanced picture: approximately 69% of all AI venture capital flows into mega-rounds of $100 million or more, creating a winner-take-most dynamic where elite companies attract disproportionate resources. Meanwhile, early-stage AI founders compete intensely for smaller checks, requiring exceptional product differentiation, credible team credentials, and demonstrated customer traction to secure seed funding and Series A rounds. The disparity between mega-rounds and early-stage funding illustrates a critical lesson: AI investors increasingly focus on proven winners with established market fit rather than betting broadly across the portfolio. For entrepreneurs navigating this challenging environment, success requires exactly what modern venture investors evaluate when making funding decisions on AI companies.

The criteria investors look for in AI startups have evolved significantly as the market matured from 2023 through 2025. Venture capital firms now demand four core competencies: technical differentiation providing clear advantages over existing solutions, market validation demonstrated through pilot programs and customer adoption signals, financial discipline reflecting sound business models and transparent unit economics, and regulatory preparedness showing awareness of evolving AI governance and compliance requirements. These standards represent a dramatic shift from earlier investment cycles where compelling narratives and large addressable markets sufficed. Today’s AI funding environment demands founders prove their technology works, customers actually want it, the business model scales profitably, and regulatory risks are manageable. This comprehensive guide explores how AI startups navigate this complex funding landscape, what venture capital investors prioritize, and the specific strategies founders employ to secure capital successfully.

The AI Funding Explosion: The Current Market

AI venture capital has reached unprecedented levels, with $192.7 billion flowing into AI startups in 2025 alone—already exceeding the entire $168.1 billion total from 2021’s previous boom year. Venture capitalists poured $192.7 billion into AI startups so far this year — setting new global records and putting 2025 on track to be the first year where more than half of total VC dollars went into the industry. This capital concentration reflects genuine market dynamics rather than pure hype: AI technology continues delivering measurable value to enterprises, productivity improvements that justify substantial spending, and competitive advantages that companies cannot ignore. However, the distribution of this capital reveals important patterns about what investors prioritize.

Nearly a third of all venture capital investment in Q2 went to just 16 companies — many of them in the AI sector — that raised funding rounds of $500 million or more. This concentration underscores a critical reality: while AI startups collectively attract record capital, the funding distribution remains highly skewed toward proven players. Major funding rounds in 2025, such as OpenAI’s record-breaking $40 billion raise led by SoftBank and ICONIQ Capital’s $13 billion round in Anthropic, demonstrate that investors clearly prefer backing proven and reputable AI companies. For early-stage founders, this means that while overall AI funding remains robust, competition for capital has intensified considerably.

What Venture Capital Investors Look For in AI Startups

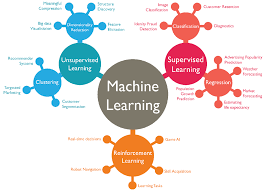

Modern venture investors have developed sophisticated frameworks for evaluating AI startup investments, moving well beyond technology potential to a comprehensive business assessment. The most successful AI companies demonstrate technical differentiation—a clear competitive advantage grounded in either superior algorithms, better training data, more efficient compute utilization, or specialized domain expertise that competitors cannot quickly replicate. Active AI investors are becoming more discerning, requiring founders to demonstrate 4 core competencies from a business standpoint: 1. Technical differentiation: A clear advantage over existing solutions. 2. Market validation: Early traction, pilot programs, or adoption signals. 3. Financial discipline: A sound financial model and transparent unit economics. 4. Regulatory preparedness: Awareness of AI governance, data privacy, and compliance trends.

Market validation represents another critical evaluation criterion. Investors want evidence that customers genuinely need the solution and will pay for it—not just theoretical market size projections. This translates into requirements for AI founders to demonstrate pilot programs with enterprise customers, letters of intent from potential buyers, or achieved customer adoption showing product-market fit. Venture capitalists recognize that AI technology abundance means execution and market positioning determine success more than technology novelty alone. Companies with 20 paying customers generating $50,000 monthly recurring revenue typically attract more venture capital interest than companies with superior algorithms lacking revenue traction.

Financial discipline and unit economics have become increasingly important as investors move past the “growth at all costs” mentality of 2023-2024. AI startups must demonstrate that their business model generates profits at scale, customer acquisition costs remain sustainable relative to lifetime value, and capital requirements to reach profitability are manageable. In 2025, venture capitalists expect AI startups to demonstrate clear progress through both measurable business metrics and concrete technical milestones. This means founders must quantify customer acquisition costs, gross margins, retention rates, and paths to profitability—not just product capabilities.

Types of Investors Funding AI Startups

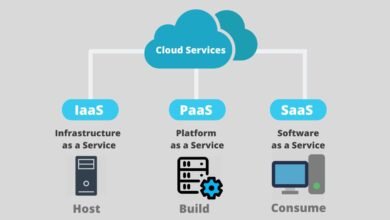

The AI startup funding ecosystem encompasses diverse investor types, each bringing different capital amounts, expertise, and strategic value. These investor categories help AI founders develop appropriate fundraising strategies and tailor their messaging accordingly. Institutional venture capital firms remain the largest source of AI funding, with established firms like Sequoia Capital, Andreessen Horowitz, Coatue, and Index Ventures making massive commitments to AI portfolios. Institutional VCs are the largest single category of investors in AI startups, providing substantial capital and strategic support across multiple stages. Their dominance in the ecosystem makes them a critical target for founders seeking follow-on funding.

Corporate venture capital has emerged as an increasingly important funding source, with corporate venture capital now rrepresenting43% of AI startup funding, reflecting the strategic importance of AI capabilities for established technology companies. Tech giants, including Microsoft, Google, Amazon, Nvidia, and Oracle, actively invest in AI startups, combining financial resources with strategic relationships and customer access that exceed what traditional venture firms provide. These corporate investors evaluate startups partly through the lens of potential acquisition targets, partnership opportunities, or technology integration possibilities within their existing platforms.

Specialized AI investors and dedicated machine learning funds have proliferated throughout 2025. Several new specialist funds have also emerged to capitalize on the AI boom. Firms like Lightning AI, Radical Ventures, and Air Street Capital focus exclusively on machine learning startups, deploying capital at a rapid pace. These focused investors bring deep technical expertise, specialized networks, and rapid decision-making compared to generalist venture firms. Angel investors and super-angels like Naval Ravikant, Elad Gil, and Cyan Banister continue writing substantial checks into early-stage AI companies, leveraging their networks and operating experience to add value beyond capital.

Seed Stage and Early Funding for AI Startups

Early-stage AI funding remains robust despite overall deal volume decline, with investors actively deploying capital at pre-seed and seed stages to capture emerging opportunities. Edge Delta’s research shows that nearly half of all AI pre-seed rounds in 2024 fell into the $500K–$2M range, reflecting how eager investors are to get in early on high-potential AI plays. This capital availability creates opportunities for AI founders with strong technical backgrounds and compelling product visions, even without extensive business experience or customer revenue.

Accelerators and incubators play significant roles in early-stage AI startup funding. Y Combinator remains the gold standard, with recent cohorts featuring numerous AI companies attracting significant follow-on funding after demo day presentations. What They Bring: Unmatched demo-day visibility, investor network, and structured mentorship. Many YC graduates have gone on to raise significant AI funding. Beyond YC, purpose-built AI incubators provide technical resources, mentorship from AI experts, and introductions to investors with h demonstrated appetite for AI deals.

Venture funds specifically targeting AI infrastructure and foundational models focus primarily on larger rounds but occasionally write seed checks alongside larger commitments. AI-First Funds: $12.4B raised across 67 specialized AI venture funds in 2024 demonstrates substantial capital flowing through dedicated AI investment vehicles. For founders seeking seed funding, successfully raising requires demonstrating exceptional technical founders, a novel technical approach, or early customer validation beyond what peer companies have achieved.

Series A, B, and Growth Stage Funding Patterns

As AI startups mature from seed stage to Series A, investor focus intensifies on revenue generation, customer concentration risk, and defensible competitive advantages. Series A investors increasingly demand $1-5M annual recurring revenue or clear paths to achieve that within 12 months. The capital available for Series A AI funding remains substantial, with funding exploding because “everyone is chasing the AI wave and many firms that started late are playing catch-up,” with funding trends accelerating through 2025 through “a broad set of AI application and infrastructure companies growing at unprecedented rates”.

Series B rounds typically range from $20 million-100 million and target AI startups with proven business models, established customer bases, and clear paths to market leadership. At this stage, investors evaluate whether the startup can achieve 10x return potential within the venture capital timeframe—typically 7-10 years from investment. Series B funding focuses on companies that have validated their market, achieved product-market fit, and demonstrated the ability to efficiently acquire customers and retain them.

Growth stage funding and later-stage rounds increasingly serve AI companies already generating substantial revenue. While the value of AI investments has surged since 2022, the number of deals has followed a downward trend, reflecting investors’ growing preference for fewer, larger bets. This shift means later-stage AI startups compete for capital from mega-funds, growth equity specialists, and secondary buyers. The largest rounds increasingly require either proven billion-dollar market opportunities or demonstrated financial metrics justifying extraordinary valuations.

Key Metrics and Traction Signals Investors Evaluate

Venture investors examining AI startups scrutinize specific metrics indicating business momentum and product-market fit. Monthly recurring revenue (MRR) and annual recurring revenue (ARR) remain the primary business metrics, with growing MRR demonstrating that customers value the solution enough to commit to ongoing subscriptions. Customer acquisition cost (CAC) and lifetime value (LTV) ratios determine whether the business model generates acceptable returns at scale. Successful AI startups typically maintain LTV to CAC ratios exceeding 3:1, indicating profitable unit economics.

Churn rate and retention metrics provide evidence of product satisfaction and market fit. AI applications with gross retention rates exceeding 90% demonstrate that customers find lasting value, while companies experiencing 20%+ monthly churn signal product-market misalignment. Engagement metrics—such as active users, feature adoption, or usage frequency—indicate product stickiness and expansion opportunities within customer accounts.

Technical metrics also matter significantly. Model Performance Stability: Consistent, reliable AI output over time that proves robustness in real-world settings demonstrates that AI models deliver reliable results under varying conditions—a critical concern for enterprise deployments. Inference latency, model accuracy, and system uptime provide technical evidence that the AI product meets production requirements. Model efficiency and compute cost per inference become increasingly important as companies scale, as improved efficiency directly impacts profitability.

Market expansion signals also influence investor sentiment. AI startups expanding into new verticals, customer segments, or geographic markets signal management confidence and versatile core technology. Early customer logos from recognizable companies, partnerships with established vendors, or integrations with widely used platforms demonstrate market credibility and distribution advantages.

The Role of Technical Founding Teams and Domain Expertise

AI startup funding patterns reveal that investor preferences strongly favor founders with deep technical credentials and proven track records. Venture capital firms invest in teams first, with exceptional founding teams able to attract funding even with incomplete products or early-stage business validation. Founders with PhDs from leading computer science programs, previous experience at top AI companies like OpenAI or DeepMind, or proven entrepreneurial success attract disproportionate investor attention.

Domain expertise distinguishes successful AI startups from commodity solutions. Founders combining deep machine learning knowledge with specific industry expertise—such as healthcare founders with medical degrees building diagnostic AI, or finance-trained founders developing AI trading systems—attract investor enthusiasm. This combination suggests founders understand both the technology and the market problem deeply, reducing execution risk substantially.

Founding team composition and complementary skills matter enormously. VC firms increasingly prefer diverse teams combining technical expertise, business acumen, and sales ability. Companies where the technical founder manages engineering while business-focused co-founders handle sales and operations outperform teams where all founders possess similar skill sets. Investors evaluate whether the founding team has successfully collaborated previously, eliminating concerns about working relationship stability.

Regulatory Compliance and Governance Considerations

As AI regulation evolves globally, venture investors increasingly evaluate regulatory preparedness and governance structures. AI startups addressing regulated industries like healthcare, finance, or critical infrastructure require demonstrated compliance knowledge and risk mitigation strategies. Founders demonstrating awareness of relevant regulations—such as HIPAA for healthcare, SOX for finance, or emerging AI governance frameworks—signal management sophistication.

Data privacy and security practices increasingly influence investment decisions as regulatory frameworks tighten worldwide. AI startups collecting customer data must demonstrate robust security practices, transparent data handling policies, and compliance with regulations like GDPR and increasingly stringent AI governance frameworks. Venture investors increasingly require evidence of SOC 2 certification or equivalent security standards before committing significant capital.

Model transparency and bias mitigation demonstrate governance maturity. AI startups operating in high-stakes applications like hiring, lending, or criminal justice must show they evaluate and mitigate model bias and maintain explainability. Investors recognize that regulatory crackdowns on biased AI systems create material legal and reputational risks warranting serious governance attention.

Competitive Moat and Long-Term Defensibility

Venture investors ultimately seek AI startups building defensible competitive advantages capable of sustaining market leadership. Traditional competitive moats—brand recognition, switching costs, network effects, or scale advantages—remain relevant, but AI-specific competitive advantages deserve particular attention. Data advantages create defensibility: companies with proprietary datasets, superior data collection mechanisms, or unique data sources build moats difficult for competitors to overcome. Model performance advantages stemming from proprietary training approaches, novel architectures, or superior hyperparameter optimization provide temporary defensibility, though this moat erodes as competitors employ similar techniques.

Customer relationships and enterprise adoption create switching costs that persist even as competitors release superior technology. AI startups deeply integrated into critical customer workflows or providing substantial ROI face lower churn risk even when better alternatives emerge. Strategic partnerships with major platforms—cloud providers, software suites, or distribution channels—create defensible advantages by securing preferred access and customer trust.

Regulatory compliance and first-mover advantages in regulated industries create defensibility as new competitors must replicate extensive compliance infrastructure. AI startups that establish market leadership in verticals like healthcare diagnostics or financial compliance face lower competitive risk than commodity solutions in unregulated spaces.

More Read: Why AI Startups Are Disrupting Traditional Industries Faster Than Ever

Conclusion

The AI startup funding landscape in 2025 represents simultaneously unprecedented opportunity and intense competition, with $192.7 billion flowing into AI companies yet concentrated primarily in mega-rounds to proven players with existing traction and defensible competitive advantages. Venture investors have evolved from backing speculative technology toward evaluating concrete business metrics, technical differentiation, market validation, financial discipline, and regulatory awareness—criteria separating fundable companies from well-intentioned projects.

Success in raising AI startup funding requires founders to demonstrate exceptional technical teams with complementary skills and proven collaboration, develop products that customers genuinely value, reflected through revenue traction and retention metrics, build defensible competitive advantages that competitors cannot quickly replicate, and maintain governance practices addressing regulatory requirements and responsible AI deployment concerns. The diversity of investor types—from institutional venture firms to corporate ventures to specialized AI funds to angel investors—creates multiple pathways to capital for founders pursuing different strategies, though capital concentration into mega-rounds remains pronounced. For aspiring AI founders navigating this ecosystem, success depends on specific investor criteria, building products demonstrating genuine market value through measurable traction, assembling capable founding teams combining technical expertise with business acumen and domain knowledge, and positioning ventures for long-term defensibility rather than short-term funding announcements.