How Semiconductor Shortages Affect Tech Prices

Discover how semiconductor shortages drive tech prices up. Learn causes, industry impact, and solutions to the chip supply crisis affecting.

The global technology landscape faces an unprecedented challenge as semiconductor shortages continue to reshape the industry. From the moment the COVID-19 pandemic disrupted global supply chains in 2020, the world has grappled with a critical shortage of microchips essential to modern electronics. What began as a temporary supply chain disruption has evolved into a complex crisis affecting virtually every sector—from consumer electronics to automotive manufacturing to artificial intelligence infrastructure.

Chip prices have skyrocketed as demand dramatically outpaces available supply. Major manufacturers, including Samsung, NVIDIA, and SK Hynix, report unprecedented shortages of memory chips crucial for smartphones, laptops, gaming consoles, and data centers. The semiconductor crisis has exposed fundamental vulnerabilities in global production networks, forcing tech companies and consumers alike to navigate rising costs and production delays. How semiconductor supply chain disruptions influence technology pricing is essential for anyone purchasing electronics or operating in technology-dependent industries.

The microchip shortage extends beyond simple supply-and-demand economics. Geopolitical tensions, concentrated manufacturing in Taiwan, natural disasters, and the explosive demand for artificial intelligence computing have created a perfect storm. As companies race to secure limited chip inventory, production timelines stretch across years, and premiums command extraordinary prices. This comprehensive analysis explores the mechanisms through which chip scarcity translates into higher tech product prices, examines affected industries, and discusses emerging solutions to stabilize global semiconductor markets.

The Semiconductor Shortage Crisis

Semiconductor shortages represent one of the most significant supply chain disruptions since the 2008 financial crisis. A chip shortage occurs when global demand for microchips exceeds manufacturing capacity, creating bottlenecks that ripple through interconnected technology ecosystems. The current crisis differs from previous disruptions in its unprecedented scale and complexity.

The microchip shortage began as a temporary disruption but has persisted with mutating complications. Between 2020 and 2023, the global chip supply crisis affected more than 169 different industries simultaneously. Unlike previous shortages limited to specific sectors or regions, this semiconductor supply disruption touched automotive production, consumer electronics manufacturing, cloud infrastructure development, and emerging artificial intelligence systems. The interconnected nature of modern manufacturing means that when chip availability declines, entire product ecosystems face delays and cost escalations.

Current chip market conditions remain volatile despite modest recovery signs. While general inventory levels outside AI-focused applications show improvement, advanced semiconductor production for artificial intelligence, high-bandwidth memory, and specialized processing units remains constrained. The semiconductor market has transitioned from broad shortages affecting all chip categories to targeted scarcity concentrated in specific high-demand applications. This segmented shortage creates unusual market dynamics where some chip categories flood inventory while others command premium pricing.

Primary Causes of the Semiconductor Supply Crisis

![]()

COVID-19 Pandemic Disruptions and Supply Chain Vulnerabilities

The coronavirus pandemic triggered an immediate surge in semiconductor demand as global workforces shifted to remote operations. Concurrent factory closures in semiconductor manufacturing hubs disrupted chip production precisely when orders exploded. The pandemic exposed how dependent modern technology industries had become on a narrow geographic concentration of manufacturing facilities, primarily located in Taiwan and South Korea.

Semiconductor manufacturers suddenly faced contradictory pressures: exploding demand for computing devices alongside constrained production capacity. Logistics bottlenecks prevented raw materials from reaching fabrication plants while finished microchips accumulated in unpredictable locations. This logistical chaos created uncertainty that manufacturers attempted to resolve through aggressive purchasing, further tightening available chip supply, and accelerating microchip shortages.

Geopolitical Tensions and Trade Restrictions

Semiconductor supply chains face unprecedented geopolitical fragmentation. Escalating U.S.-China trade tensions have prompted export restrictions on advanced chip technology, forcing companies to reconsider sourcing strategies and supply chain architecture. The United States has implemented restrictions limiting semiconductor exports to Chinese firms, disrupting conventional trade relationships and forcing manufacturers to rebuild supply networks across alternative regions.

These geopolitical complications extend beyond bilateral tensions. Taiwan’s precarious geopolitical position creates systemic vulnerability, as over 60% of the world’s advanced microchips originate from Taiwanese fabrication plants. Any disruption—whether political, military, or natural—would devastate global semiconductor production and trigger severe chip shortages across all technology sectors. This geographic concentration represents a fundamental weakness in global semiconductor infrastructure that perpetuates market volatility and justifies elevated chip costs.

Artificial Intelligence Demand Explosion

Explosive growth in artificial intelligence computing has fundamentally altered semiconductor demand patterns. Major technology companies, including Google, Amazon, Microsoft, and OpenAI, are investing staggering sums into data center infrastructure to support AI model training and deployment. These hyperscalers require specialized memory chips—particularly high-bandwidth memory (HBM), DRAM, and NAND flash—at unprecedented volumes.

AI-driven semiconductor demand has created a supply crisis fundamentally different from previous shortages. While consumer electronics demand fluctuates seasonally, AI chip consumption grows relentlessly. Chipmakers have voluntarily concentrated production capacity toward lucrative AI-focused applications, deliberately limiting the supply of consumer-grade memory to maintain elevated pricing. This strategic semiconductor production reallocation means that consumer electronics manufacturers now compete directly with data center operators for limited microchip availability, driving both scarcity and pricing pressures.

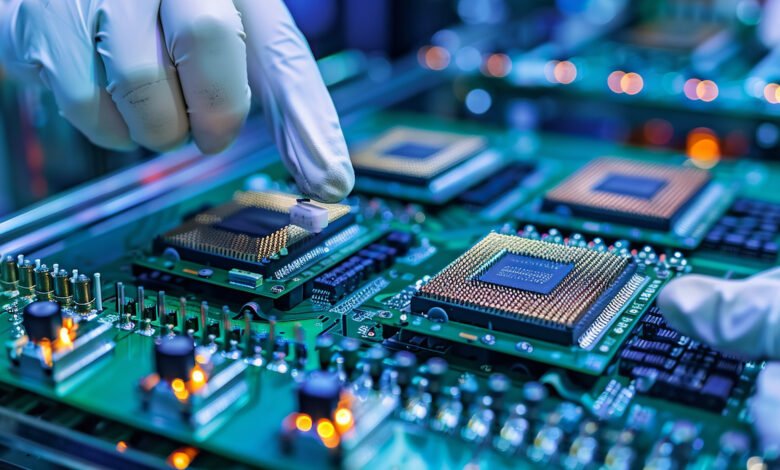

Limited Manufacturing Capacity and Extended Production Lead Times

The semiconductor industry faces structural constraints that prevent rapid capacity expansion. Building new fabrication plants (“fabs”) requires capital investments exceeding $10 billion, extended construction timelines spanning 3-5 years, and highly specialized technical expertise. Semiconductor manufacturers hesitate to invest in expanded capacity given uncertainty about future demand, particularly regarding potential AI market corrections.

Semiconductor production involves extraordinarily complex processes requiring pristine manufacturing environments and rare specialized materials. Lead times for microchip manufacturing currently extend to 24 weeks or longer for some components, meaning that orders placed today won’t reach customers until 2026 at the earliest. This extended timeline prevents rapid market adjustments and perpetuates supply imbalances. Even when new fabrication capacity begins operations, it typically takes 18-24 months to reach full production efficiency, meaning supply constraints will persist through 2026 and potentially beyond.

How Semiconductor Shortages Directly Drive Tech Prices Higher

Increased Manufacturing Costs Due to Chip Scarcity

When chip supply becomes constrained, semiconductor costs escalate dramatically. Memory manufacturers have raised prices by 60% or more in recent months as AI demand crushes available capacity. These elevated microchip prices directly translate into higher production expenses for consumer electronics manufacturers. When the most expensive input materials increase dramatically, manufacturing cost structures shift, and manufacturers typically transfer these expenses to consumers through higher product prices.

The pricing mechanism operates through competitive procurement dynamics. When multiple manufacturers compete for limited chip availability, they bid prices upward. Companies willing to pay premium prices secure limited inventory while competitors face delayed fulfillment or component unavailability. This bidding dynamic creates a reinforcing cycle where semiconductor shortage consequences directly inflate technology product prices across consumer markets.

Delayed Product Launches and Constrained Production Volumes

Semiconductor supply constraints force technology companies to reduce production volumes or delay product launches entirely. When Apple, Samsung, Sony, and other major manufacturers cannot secure sufficient chips, they must make difficult choices: reduce output, delay releases, or accept lower profitability. Each option carries consequences that ultimately affect consumers through higher prices or reduced availability.

Product delay strategies effectively reduce chip consumption by postponing demand into future periods, but this approach frustrates consumers and reduces manufacturer revenues. Alternatively, companies reduce production volumes while maintaining existing prices, effectively raising per-unit costs. These dynamics explain why flagship smartphones, gaming consoles, and laptop computers command premium prices even when manufacturers face production constraints. The microchip shortage restricts supply, supporting prices at elevated levels despite softening consumer demand in non-AI sectors.

Supplier Power and Opportunity Pricing

Semiconductor manufacturers possess unprecedented pricing power during supply-constrained environments. With demand exceeding supply by significant margins, chip suppliers can raise prices unilaterally without fear of losing customers. NVIDIA’s GPU pricing during the chip shortage exemplifies this dynamic—the company raised prices substantially while customers had no alternative suppliers offering comparable performance.

This supplier-side pricing power extends beyond just raising listed prices. Manufacturers implement allocation strategies favoring high-margin customers, demand minimum purchase commitments, and impose “take-or-pay” contracts requiring customers to accept specified volumes regardless of actual needs. These aggressive supplier tactics stem from the semiconductor supply crisis, but ultimately increase costs for downstream manufacturers who pass these expenses to consumer markets.

Industry-Specific Impacts of Chip Shortages on Technology Prices

Consumer Electronics: Smartphones, Laptops, and Computing Devices

Consumer electronics manufacturers face severe semiconductor supply pressures affecting their product portfolios. Smartphone manufacturers require enormous volumes of memory chips (DRAM and NAND flash) for basic functionality—modern phones typically demand 8-12GB of memory minimum. As the chip shortage intensifies, smartphone manufacturers struggle to meet demand without premium pricing.

Laptop and personal computer manufacturers report particularly acute microchip shortage impacts. Memory manufacturers have announced phase-outs of older DDR4 memory to concentrate production on higher-margin DDR5 and specialized AI chips. This strategic semiconductor production shift creates supply gaps for conventional computing devices, pushing prices upward. Commercial Times estimates that memory chip premiums alone could add nearly $96 to basic PC pricing in 2026—a substantial percentage increase for budget computing devices.

Gaming Consoles and Graphics Processing Units

Gaming hardware faces extreme chip shortage complications. NVIDIA and AMD graphics processors command premium pricing as AI applications consume vast quantities of GPU memory. The semiconductor shortage has effectively created two markets: consumer GPUs at inflated prices and enterprise GPUs at even steeper premiums. Rumor suggests that NVIDIA may not release consumer GPU refreshes planned for 2026, instead concentrating production on data center processors where margins far exceed consumer market returns.

Gaming consoles from Sony, Microsoft, and Nintendo similarly struggle with chip availability. These devices require specialized processors combining CPU and GPU functionality—components where semiconductor supply remains particularly constrained. Manufacturers have implemented production caps and regional availability restrictions rather than raise prices, reflecting strategic decisions to maintain console pricing while restricting supply to markets where demand justifies inventory allocation.

Automotive Sector and Electric Vehicle Manufacturing

The automotive industry remains severely vulnerable to semiconductor supply disruptions. Modern vehicles require 1,400-1,500 microchips for basic functionality, with advanced autonomous driving systems demanding substantially more sophisticated processors. During the 2020-2023 chip shortage, automotive manufacturers lost an estimated $210 billion in global revenue as production constraints prevented vehicle assembly.

Electric vehicles require additional semiconductor complexity compared to conventional vehicles, including power management chips, battery monitoring systems, and advanced driver assistance processors. The microchip shortage particularly impacts EV manufacturers, who cannot source specialized power semiconductors. This supply constraint explains why electric vehicle prices remain elevated and why production growth has disappointed investor expectations despite surging consumer interest.

Data Centers and Artificial Intelligence Infrastructure

Data center operators face the most acute semiconductor supply constraints currently. High-bandwidth memory chips, specialized AI processors, and support infrastructure components all experience severe shortages as cloud providers expand capacity. Major technology companies accept extended lead times and premium pricing because AI infrastructure expansion generates sufficient returns to justify elevated chip costs.

This dynamic creates a vicious cycle: AI demand increases semiconductor shortage pressures, which raises chip prices, which forces consumer electronics manufacturers to accept lower profit margins or reduce production volumes. The concentration of available microchip supply toward AI applications means consumer-facing technology sectors subsidize data center expansion through constrained supply and elevated pricing.

Specific Price Increases Across Technology Markets

Memory chip pricing has increased dramatically. Samsung raised memory chip prices by up to 60% compared to September 2025 levels, according to industry sources. These extraordinary increases—on top of prior price escalations—represent some of the most aggressive pricing actions in semiconductor industry history. Memory module manufacturers have delayed product launches scheduled for late 2025 into 2026 to assess pricing stabilization, anticipating that current elevated prices are unsustainable.

Some forecasts suggest that memory price increases could extend across a decade if semiconductor manufacturers continue restricting production capacity. This extraordinarily long adjustment timeline reflects the structural imbalances between AI demand driving toward infinity, while consumer electronics demand remains flat or declining. The resulting price structure dramatically disadvantages cost-conscious consumers and emerging market manufacturers dependent on affordable computing devices.

Technology retailers report that consumer devices now command substantially higher prices. Smartphones, according to manufacturer warnings, will see significant retail price increases in 2026. Laptops and personal computers face memory cost increases of $96 or more added to base models. These cumulative price increases reduce consumer purchasing power and extend device replacement cycles as consumers delay upgrades, awaiting price stabilization.

Global Supply Chain Responses and Diversification Strategies

Government Intervention and Semiconductor Policy

Governments worldwide recognize that semiconductor security represents critical national security infrastructure. The United States CHIPS Act committed over $52 billion toward domestic semiconductor research and manufacturing development. The European Union’s Chips Act allocated €43 billion (approximately $47 billion) toward expanding European semiconductor production capacity from 10% to 20% of global market share by 2030.

These government initiatives aim to reduce geographic concentration of semiconductor manufacturing and build resilience into global chip supply chains. However, capacity expansion requires years to implement, and newly constructed fabrication plants take additional months to reach production efficiency. Government-sponsored initiatives should improve semiconductor availability starting in 2027-2028, but offer no immediate relief to current chip shortage pressures.

Corporate Supply Chain Resilience Initiatives

Major technology companies are implementing strategic responses to semiconductor supply chain vulnerabilities. Apple has invested substantially in designing proprietary processors (M1, M2, M3 series), reducing dependence on external semiconductor suppliers. This vertical integration strategy reduces exposure to chip shortages but requires massive research and development investment that smaller manufacturers cannot replicate.

Companies are also diversifying supplier bases geographically, shifting production from China toward Vietnam, India, Mexico, and other regions offering lower geopolitical risk. These diversification strategies reduce vulnerability to concentrated supply disruptions but introduce new complexities, including quality control challenges, logistics complications, and adaptation periods as suppliers ramp production.

Long-Term Outlook for Semiconductor Prices and Availability

Industry forecasts suggest a gradual improvement in chip supply conditions beginning in 2027. New semiconductor manufacturing capacity currently under construction in the United States, Europe, and Asia should reach production efficiency during this period. However, AI demand continues to accelerate, potentially consuming much of this new capacity and preventing consumer-focused pricing normalization.

The semiconductor market is unlikely to return to pre-shortage pricing levels. Chipmakers have demonstrated willingness to maintain production constraints to support elevated pricing. Without competitive pressure from expanding capacity, microchip prices may stabilize at levels substantially higher than 2019-2020 baselines. This persistent elevation reflects fundamental changes in supply-demand dynamics rather than temporary disruptions.

Consumer electronics manufacturers should prepare for an extended period of elevated component costs. The combination of persistent AI demand, geopolitical tensions, and manufacturing capacity constraints suggests that semiconductor shortage impacts will persist through 2026 and potentially into 2027. Technology purchasers who can delay buying decisions may benefit from modest price reductions beginning in 2027-2028 as new capacity reaches production. However, those requiring immediate technology upgrades should expect to pay substantial premiums.

More read: Industrial IoT Transforming Manufacturing with Connected Systems

Conclusion

Semiconductor shortages represent one of the most significant economic disruptions affecting modern technology markets, with direct consequences for consumer electronics pricing that extend far beyond pure supply-demand economics. The convergence of geopolitical tensions, geographic concentration of manufacturing capacity in Taiwan, explosive artificial intelligence demand, and structural constraints preventing rapid capacity expansion has created a persistent chip supply crisis that continues driving technology product prices substantially higher.

While government initiatives and corporate diversification strategies offer promise for gradual improvement beginning in 2027, consumers and businesses should prepare for extended periods of elevated semiconductor costs and constrained availability through 2026. These dynamics help stakeholders make informed decisions about technology purchasing timing, supply chain strategy, and long-term infrastructure investment—particularly given the fundamental importance of semiconductors to modern economic function across industries ranging from consumer electronics to automotive manufacturing to critical artificial intelligence infrastructure development.